Learn everything about Fortis crypto staking — how it works, the best platforms in Australia, staking rewards, APY examples, Fortis staking dashboard, risks like slashing and volatility, and whether staking is better than holding for long-term passive income.

Fortis Staking Dashboard

FTS Balance: –

Your Staked: –

Pending Rewards: –

Reward Will Be Sent To: –

Staking Started At: –

Status: –

Next Expected Reward Time: –

Buy Fortis Cryptocurrency

Table of Contents

What is Crypto staking?

Crypto staking is a way for investors to earn passive income from their digital assets while helping to support the security and efficiency of blockchain networks. In simple terms, it involves “locking up” or delegating your crypto holdings to a blockchain that uses a Proof-of-Stake (PoS) or Delegated Proof-of-Stake (DPoS) consensus mechanism. Instead of miners solving complex equations (like in Bitcoin’s Proof-of-Work system), validators are chosen based on the amount of coins they stake to confirm transactions and create new blocks.

When you stake your cryptocurrency, you essentially become part of the network’s backbone. In return for committing your tokens, you receive rewards — usually in the form of additional tokens. This makes staking appealing to long-term investors who prefer holding their crypto rather than trading frequently.

Key Points to Understand About Staking:

- Passive Income – Stakers earn rewards, often expressed as an Annual Percentage Yield (APY), which varies depending on the project and network conditions.

- Network Security – By staking, you help maintain blockchain security, as validators are financially motivated to act honestly.

- Lock-Up Periods – Some networks require you to keep your tokens locked for a fixed period, while others allow flexible staking.

- Risks Involved – Market volatility, validator misbehavior, and lock-up restrictions can affect both the value of your investment and your ability to access funds quickly.

In essence, staking is the crypto equivalent of earning interest on a savings account, but instead of banks, you’re supporting a blockchain. For projects like Fortis and Mad Gorilla Coin, staking provides investors with a way to grow their holdings while building trust and stability in the ecosystem.

Is Staking Your Crypto Worth It?

Whether crypto staking is worth it depends on your investment goals, risk tolerance, and the specific cryptocurrency you choose. For many investors, staking provides a steady stream of rewards that can outperform traditional savings interest rates. Unlike trading, where profits depend on timing the market, crypto staking allows long-term holders to earn passive income simply by keeping their assets locked on a Proof-of-Stake blockchain.

One of the biggest advantages of crypto staking is its potential returns. Many projects offer Annual Percentage Yields (APY) ranging from 4% to 20%, and in some cases even higher for newer tokens. This makes staking attractive to those who prefer a predictable reward system rather than chasing price spikes. For example, Fortis offers a fixed daily return of 0.1%, which equals around 36.5% per year if compounded — far higher than traditional banking interest rates.

At the same time, crypto staking isn’t risk-free. Price volatility can wipe out the value of your rewards, and some platforms impose lock-up periods that prevent you from selling your tokens when the market drops. There’s also the risk of “slashing” on certain networks, where validators acting dishonestly lose part of their stake. Understanding these risks is crucial before deciding whether staking is worth it.

Another factor to consider with crypto staking is how it fits into your broader investment strategy. If you’re holding assets like Ethereum, Cardano, or Solana for the long term, staking them can be an excellent way to compound your holdings without additional effort. Meanwhile, projects like Fortis, with its 0.1% daily return model, may appeal to investors looking for higher compounding growth — but this also requires confidence in the project’s long-term stability.

Overall, crypto staking can be worth it if you are a long-term believer in the project, comfortable with market fluctuations, and want to generate passive rewards while supporting blockchain security. For investors seeking higher returns, staking platforms with stronger APYs like Fortis can provide faster portfolio growth compared to more established coins.

Pros and Cons of Crypto Staking

| Pros of Crypto Staking | Cons of Crypto Staking |

|---|---|

| Generates passive income with APYs higher than traditional savings accounts | Exposure to market volatility – token value can drop even if rewards are earned |

| Supports blockchain security by helping validate transactions | Some platforms require lock-up periods, reducing liquidity |

| Compounds holdings for long-term investors | Risk of slashing penalties if validators misbehave on certain networks |

| Environmentally friendly compared to Proof-of-Work mining | Lower flexibility for short-term traders needing immediate access to funds |

| Potential to earn higher yields with new or smaller projects | Smaller, high-yield projects may carry higher project sustainability risks |

Real-World Example: How Much Can You Earn from Crypto Staking?

Let’s say you invest $1,000 into crypto staking. Here’s how the earnings would look after one year, based on different APYs:

| Token / Network | Typical APY | 1-Year Reward on $1,000 | Notes |

|---|---|---|---|

| Ethereum (ETH) | ~4–5% | $40–$50 | Very stable, widely trusted, but lower yield |

| Cardano (ADA) | ~5–6% | $50–$60 | Good long-term project with steady returns |

| Polkadot (DOT) | ~12% | $120 | Higher yield but more volatility |

| Fortis (FTS) | ~36.5% (0.1% per day) | ~$365 | High fixed daily reward, faster compounding |

| New/Small Tokens | 20%+ | $200+ | High rewards but higher project risk and uncertainty |

This makes it clear that while crypto staking in networks like Ethereum and Cardano offers steady but modest returns, staking with Fortis provides much higher daily compounding potential. For investors looking for faster growth, Fortis can be attractive — but as with all high-yield staking, it’s important to assess long-term sustainability and market stability.

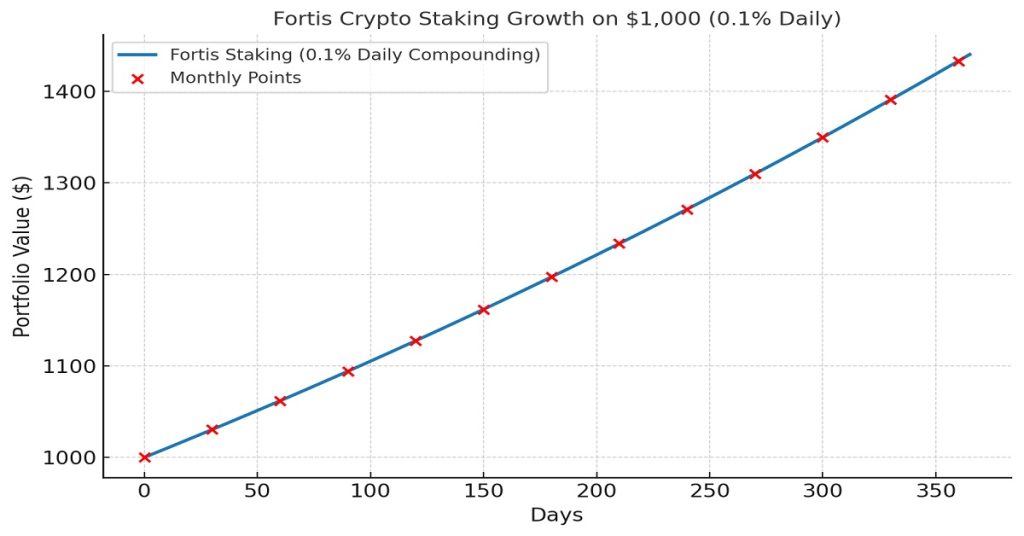

Fortis Daily Compounding Example

To see the power of Fortis’ 0.1% daily crypto staking rewards, let’s break it down with daily compounding. If you stake $1,000 worth of Fortis (FTS):

- After 30 days (1 month): ~$1,030

- After 90 days (3 months): ~$1,093

- After 180 days (6 months): ~$1,197

- After 365 days (1 year): ~$1,440

That’s about a 44% growth in one year with daily compounding, compared to the flat 36.5% simple annual return. This example shows why Fortis staking can be especially rewarding for long-term holders who leave their tokens staked — the daily compounding effect boosts returns significantly over time.

Fortis Staking Growth on $10,000 (0.1% Daily Compounding)

| Month | Day | Portfolio Value ($) | Staking Profit ($) |

|---|---|---|---|

| Month 0 | 0 | 10,000.00 | 0.00 |

| Month 1 | 30 | 10,304.39 | 304.39 |

| Month 2 | 60 | 10,618.05 | 618.05 |

| Month 3 | 90 | 10,941.25 | 941.25 |

| Month 4 | 120 | 11,274.29 | 1,274.29 |

| Month 5 | 150 | 11,617.47 | 1,617.47 |

| Month 6 | 180 | 11,971.10 | 1,971.10 |

| Month 7 | 210 | 12,335.49 | 2,335.49 |

| Month 8 | 240 | 12,710.97 | 2,710.97 |

| Month 9 | 270 | 13,097.88 | 3,097.88 |

| Month 10 | 300 | 13,496.56 | 3,496.56 |

| Month 11 | 330 | 13,907.39 | 3,907.39 |

| Month 12 | 360 | 14,330.72 | 4,330.72 |

Can You Stake Crypto in Australia?

Yes, you can stake crypto in Australia, and it’s one of the most accessible ways for investors to earn passive income from digital assets. Instead of just holding coins in a wallet, staking allows Australians to participate in blockchain networks and earn rewards. With competitive APYs available, more investors are choosing to stake crypto in Australia as an alternative to traditional interest-bearing investments.

The easiest way to stake crypto in Australia is through well-known crypto exchanges. Platforms like Swyftx and CoinSpot offer local solutions, while global exchanges such as Binance and Kraken provide broader token choices. These services make it simple for beginners to start earning staking rewards on Ethereum, Cardano, Solana, and Polkadot without managing validator nodes themselves. For those seeking higher yields, new projects like Fortis staking also provide a dedicated dashboard where users can view rewards, lock their tokens, and monitor daily returns.

When you stake crypto in Australia, taxation is another key factor. The Australian Taxation Office (ATO) treats staking rewards as taxable income, meaning investors must report them alongside their regular earnings. While staking is fully legal, accurate record-keeping is essential to stay compliant. Some exchanges even provide annual transaction summaries to make reporting staking rewards easier for Australian investors.

For long-term holders, choosing to stake crypto in Australia is a way to compound returns while supporting blockchain ecosystems. Whether you prefer flexible staking with easy withdrawals or fixed-term staking with higher APYs, investors now have multiple pathways. The Fortis staking dashboard is an example of how smaller projects provide transparency, daily compounding rewards, and user-friendly access for investors seeking alternatives to large exchanges.

Best Platforms to Stake Crypto in Australia (Comparison)

| Platform | Supported Coins | Typical APY Range | Features |

|---|---|---|---|

| Swyftx | ETH, ADA, SOL, DOT, AVAX | 4% – 12% | Easy-to-use Australian exchange, no lock-up for some coins |

| CoinSpot | ETH, ADA, DOT, ALGO, ATOM | 2% – 10% | Regulated Australian exchange with beginner-friendly dashboard |

| Binance | ETH, SOL, BNB, DOT + many | 4% – 15% | Wide token range, flexible and locked staking options |

| Kraken | ETH, ADA, DOT, ATOM, SOL | 4% – 20% | Global reputation, strong security features |

| Fortis Staking | FTS (Fortis Token) | ~36.5% annually (0.1% daily) | Dedicated crypto staking dashboard with daily compounding rewards |

Is Staking Better Than Holding?

For many investors, crypto staking offers a clear advantage over simply holding coins in a wallet. While long-term holding (or “HODLing”) depends solely on price appreciation, staking generates passive income regardless of market conditions. This means that even if the market is sideways, investors can still earn rewards through staking instead of waiting for price gains alone.

One key benefit of staking Crypto compared to holding is the power of compounding. When rewards are restaked, the portfolio grows faster than just holding a static amount of tokens. For example, staking platforms like Ethereum and Cardano provide 4–6% APY, while projects like Fortis can offer daily compounding of 0.1%, which accelerates growth over time. Holding alone doesn’t take advantage of this compounding effect.

At the same time, cryptocurrency staking carries different risks than holding. If you lock your tokens in a staking program, you may lose liquidity and flexibility to sell quickly during market downturns. Holding, on the other hand, allows investors to keep their assets liquid, which can be useful when markets are highly volatile. This makes the decision between holding and staking a matter of balancing flexibility versus reward potential.

Another point to consider is that staking Cryptocurrency strengthens blockchain networks by helping validate transactions and maintain security. While holding coins supports price stability through reduced supply, staking actively contributes to the ecosystem. For investors who care about both returns and the health of the network, staking is often seen as more beneficial than passively holding.

In conclusion, staking crypto can be better than holding if your goal is to earn regular income and maximize long-term portfolio growth. However, if you prioritize liquidity, quick access to funds, and minimal risk exposure, holding may still suit your strategy. The best approach often combines both — keeping some tokens staked for rewards while holding a portion liquid for trading opportunities.

Can I Lose My Crypto if I Stake It?

When it comes to staking, one of the biggest concerns investors have is whether they can lose their funds. The answer is yes — there are risks involved. While staking can provide attractive passive income, it’s not completely risk-free. Depending on the platform and blockchain you use, your staked tokens may be subject to penalties, lock-up restrictions, or even market downturns that reduce their overall value.

A common risk in crypto staking is something known as slashing penalties. On certain blockchains like Ethereum or Polkadot, if a validator acts dishonestly or goes offline too often, a portion of the staked funds can be “slashed,” meaning investors lose part of their stake. While large exchanges usually manage this risk on behalf of users, those staking directly with validators may be exposed to slashing events.

Another risk with crypto staking is price volatility. Even if you earn staking rewards, the value of your crypto can drop sharply during a bear market. For example, a 10% reward might not mean much if the token itself loses 30% of its value over the same period. This makes it important for investors to understand that staking rewards don’t eliminate the risks of market fluctuations.

Lock-up periods also pose risks in staking crypto system. Many platforms require investors to lock their tokens for weeks or months, preventing withdrawals during that time. If prices fall during the lock-up, investors may not be able to exit their position until the staking term ends. While flexible staking options exist, they often offer lower rewards than fixed-term programs.

Overall, yes — you can lose money in cryptocurrency staking, but the risks vary depending on the token, platform, and method you choose. The safest approach is to stake on well-established platforms, diversify your staked assets, and never lock up more funds than you’re willing to keep invested long term. By balancing these factors, you can enjoy staking rewards while minimizing exposure to unnecessary risks.

Is Staking Better Than Mining?

For many investors, crypto staking is considered a better option than mining because it requires far fewer resources. Mining depends on expensive hardware, constant electricity consumption, and technical expertise, whereas staking only requires holding coins on a Proof-of-Stake blockchain. This makes staking more accessible to everyday investors who want to earn rewards without investing in costly mining equipment.

Another advantage of staking cryptocurrency compared to mining is energy efficiency. Mining on Proof-of-Work blockchains like Bitcoin consumes huge amounts of electricity, which raises environmental concerns and operating costs. By contrast, crypto staking allows investors to support blockchain networks in a far more eco-friendly way, since validators are chosen based on the amount of tokens staked rather than raw computing power.

When comparing rewards, staking Crypto can also be more predictable than mining. Crypto Stakers typically receive fixed or estimated APYs, such as 4–6% on Ethereum or up to 36.5% annually with projects like Fortis, while mining rewards fluctuate depending on network difficulty, electricity costs, and competition. This makes staking appealing for those seeking steady, long-term returns.

That said, mining does have one advantage over cryptocurrency staking — liquidity. Miners can usually sell their mined coins immediately, whereas some staking platforms impose lock-up periods. However, as Proof-of-Stake becomes more widely adopted, the benefits of staking are increasingly outweighing the traditional mining model, especially for retail investors.

In conclusion, cryptocurrency staking is generally better than mining for most individuals due to lower barriers to entry, reduced costs, predictable returns, and environmental sustainability. Mining still has its place, particularly with Bitcoin, but the shift toward Proof-of-Stake suggests staking will dominate the future of blockchain participation.

Crypto Staking vs. Crypto Mining (Comparison)

| Factor | Crypto Staking | Crypto Mining |

|---|---|---|

| Technology | Proof-of-Stake (validators chosen based on tokens staked) | Proof-of-Work (miners solve complex computations) |

| Accessibility | Easy to start — just hold and lock tokens | Requires expensive hardware (ASICs/GPUs) |

| Costs | Minimal (no electricity or equipment needed) | High energy costs + equipment maintenance |

| Rewards | Predictable APY (e.g., 4–6% ETH, ~36.5% with Fortis) | Variable, depends on network difficulty and costs |

| Environmental Impact | Energy-efficient, eco-friendly | Energy-intensive, criticized for high carbon footprint |

| Liquidity | Some tokens locked for set periods | Mined coins can usually be sold immediately |

| Long-Term Outlook | Growing rapidly with Ethereum, Cardano, Solana, Fortis | Limited mainly to Bitcoin and older blockchains |

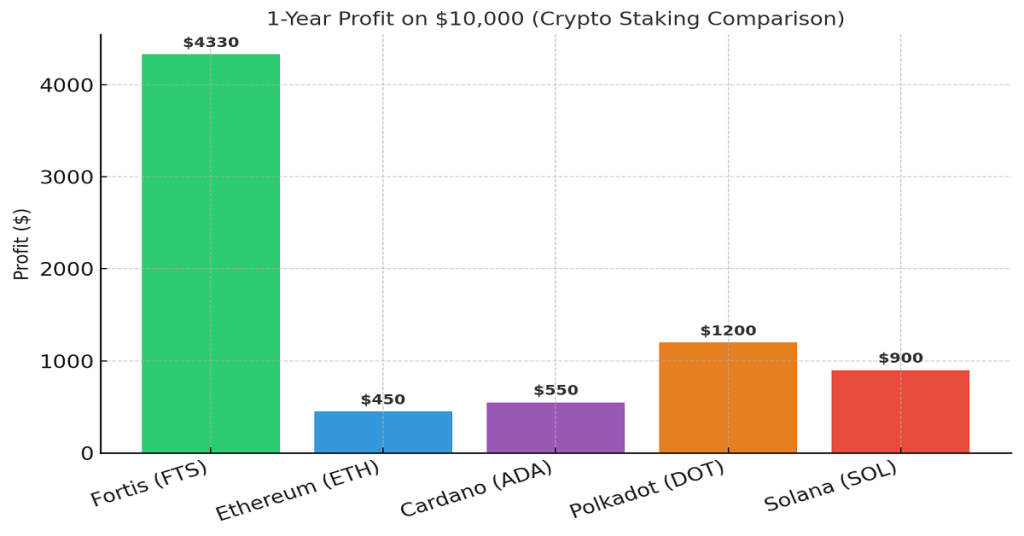

What is the Most Profitable Staking Crypto?

The most profitable crypto staking option often comes down to a balance between high APYs and long-term stability. Traditional Proof-of-Stake coins like Ethereum (ETH) and Cardano (ADA) offer steady but modest returns of 4–6% per year, making them safe but less lucrative. By comparison, Fortis staking provides a 0.1% daily return (around 36.5% annually with compounding), which places it among the most profitable choices for investors who want higher growth.

When assessing the most profitable crypto staking, it’s important to consider both the rewards and the sustainability of the project. Polkadot (DOT) and Solana (SOL) can deliver 8–15% APYs, while Fortis outpaces them with significantly higher returns thanks to its daily compounding model. For investors in Australia and globally, having access to the Fortis staking dashboard makes it easy to track rewards and reinvest earnings, amplifying overall profits.

Another reason Fortis staking stands out in the profitable crypto staking landscape is its compounding effect. A $10,000 stake in Fortis can grow to more than $14,000 in just one year, far surpassing what traditional tokens like Ethereum could generate. While high APY projects can carry more risk, Fortis offers transparency with a dedicated dashboard and predictable reward system, making it a unique opportunity for investors looking beyond the typical 5–10% returns.

Ultimately, the most profitable crypto staking depends on your risk tolerance. Conservative investors may choose Ethereum or Cardano for safety, while growth-focused stakers often turn to Polkadot or Solana for higher yields. However, for those seeking maximum compounding rewards, Fortis staking is one of the most profitable cryptos available today, offering consistent daily returns that multiply portfolio growth faster than most traditional staking options.

Most Profitable Crypto Staking (Comparison)

| Crypto / Platform | Typical APY | 1-Year Profit on $10,000 | Notes |

|---|---|---|---|

| Fortis (FTS) | ~36.5% (0.1% daily) | ~$4,330 (with daily compounding) | Dedicated Fortis staking dashboard with daily rewards |

| Ethereum (ETH) | ~4–5% | ~$400–$500 | Most popular staking coin, very stable |

| Cardano (ADA) | ~5–6% | ~$500–$600 | Low-risk, consistent staking ecosystem |

| Polkadot (DOT) | ~12% | ~$1,200 | Higher yield but more volatile |

| Solana (SOL) | ~8–10% | ~$800–$1,000 | Strong growth but subject to network risks |

This table shows clearly that while ETH and ADA provide safe but smaller returns, Fortis staking delivers significantly higher compounding rewards, making it one of the most profitable staking cryptos available.

Who Pays the Most for Staking Crypto?

When it comes to crypto staking, the platforms and tokens that pay the most are typically those offering high APYs or daily compounding rewards. Established blockchains like Ethereum and Cardano provide steady returns of around 4–6% annually, while networks such as Polkadot and Solana can pay 8–15%. However, these are still modest compared to newer projects that design their tokenomics around higher staking incentives to attract investors.

Currently, some of the projects that pay the most in crypto staking are smaller tokens and newer ecosystems that want to build user adoption. While they may advertise APYs of 20% or more, the risk is that sustainability is not guaranteed. This is why it’s important for investors to evaluate whether high-paying staking platforms can deliver consistent long-term rewards rather than chasing short-term gains.

One standout example of who pays the most in crypto staking is Fortis, which offers a fixed 0.1% daily reward (around 36.5% annually with compounding). Unlike traditional networks, Fortis provides a dedicated staking dashboard that allows investors to track daily rewards and reinvest automatically. This level of compounding makes Fortis one of the highest-paying staking options compared to Ethereum, Cardano, or Polkadot.

That said, the platforms that pay the most in crypto staking usually come with higher risks. High APYs can signal early growth strategies, but they may not last forever if the project lacks adoption or trading volume. For this reason, investors often combine high-yield staking like Fortis with safer but lower-paying options like Ethereum or Cardano, balancing profitability with long-term security.

In conclusion, the projects and platforms that pay the most for crypto staking are those with innovative reward systems, such as Fortis with daily compounding. While Ethereum, Cardano, and Polkadot remain stable options, Fortis currently leads the pack in terms of raw staking profitability. The key for investors is to weigh high payouts against project sustainability to avoid unnecessary risks.

Which Crypto is Worth Staking?

When deciding which tokens are worth committing to crypto staking, the answer depends on your goals — safety, steady returns, or higher-risk growth. For conservative investors, established coins like Ethereum (ETH) and Cardano (ADA) are worth staking because they provide predictable rewards of 4–6% annually. These networks are proven, widely adopted, and offer reliable long-term staking rewards, making them strong options for those prioritizing stability.

For those seeking higher returns, Polkadot (DOT) and Solana (SOL) stand out in the crypto staking landscape. With APYs ranging from 8–15%, these networks provide more attractive yields while still being relatively established in the market. They’re worth staking if you’re comfortable with some volatility but still want to back blockchains with strong ecosystems and active development.

One of the most rewarding opportunities in crypto staking today is Fortis, which offers a fixed 0.1% daily return — around 36.5% annually with compounding. Unlike traditional platforms, the Fortis staking dashboard allows investors to monitor rewards in real-time and reinvest for faster growth. This makes Fortis particularly worth staking for investors looking to maximize compounding returns, though it comes with higher risks than staking established coins like Ethereum.

Ultimately, the cryptos worth staking are those that align with your risk profile. Conservative investors may stick with Ethereum and Cardano for stability, moderate risk-takers might prefer Polkadot or Solana for higher yields, while growth-focused investors often consider Fortis for its unmatched daily compounding rewards. By diversifying across these choices, you can make crypto staking both profitable and sustainable.

Top 5 Cryptos Worth Staking for Passive Income in 2025

| Crypto / Token | Typical APY | Risk Level | Why It’s Worth Staking |

|---|---|---|---|

| Ethereum (ETH) | 4–5% annually | Low | Most established network, strong security, widely adopted |

| Cardano (ADA) | 5–6% annually | Low | Reliable staking system, eco-friendly, steady long-term rewards |

| Polkadot (DOT) | 10–12% annually | Medium | Higher yields, strong interoperability project, growing ecosystem |

| Solana (SOL) | 8–10% annually | Medium–High | Fast transactions, good staking returns, but some network instability |

| Fortis (FTS) | ~36.5% annually (0.1% daily) | High | Dedicated Fortis staking dashboard with daily compounding rewards, high profitability |

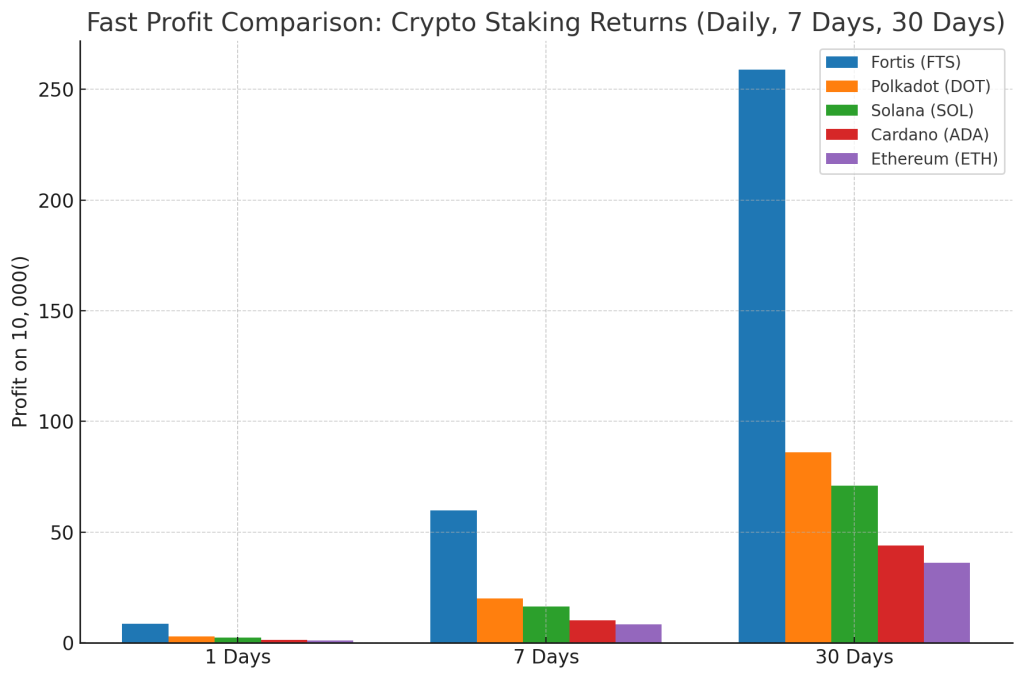

What is the Best Crypto for Fast Profit?

When it comes to crypto staking, the best option for fast profit is usually a project that offers high APYs with short compounding cycles. Traditional coins like Ethereum and Cardano provide stable rewards, but their 4–6% APY is designed for long-term growth rather than quick returns. Investors who want fast profit often look toward newer projects or tokens with higher reward structures.

One of the standout options for fast profit in crypto staking is Fortis, which offers a fixed 0.1% daily return (around 36.5% annually with compounding). Unlike platforms where rewards are distributed weekly or monthly, Fortis provides daily payouts through its dedicated staking dashboard. This means investors can see their portfolio grow faster, making it a strong candidate for those seeking quick compounding gains.

While Fortis leads in fast-profit opportunities, some mid-tier coins like Polkadot and Solana are also worth considering. These networks typically offer 8–15% APY, which is higher than Ethereum or Cardano, and they distribute staking rewards more frequently. However, compared to Fortis’ daily compounding, their growth still favors medium- to long-term profit rather than rapid short-term returns.

It’s important to remember that chasing fast profit in crypto staking also involves higher risk. Tokens with the highest APYs, such as Fortis, can deliver much greater returns but may face higher volatility than established coins. The safest approach is to balance your portfolio: allocate some funds to high-profit staking like Fortis for daily compounding, while keeping a portion in stable coins like Ethereum for security.

In conclusion, the best crypto for fast profit through crypto staking is Fortis, thanks to its 0.1% daily reward model and dedicated dashboard. While Polkadot and Solana provide attractive yields as well, Fortis stands out as the top choice for investors who want faster compounding and more visible daily growth.

Best Cryptos for Fast Profit Through Staking

| Crypto / Token | APY | Reward Frequency | Fast Profit Potential | Notes |

|---|---|---|---|---|

| Fortis (FTS) | ~36.5% annually (0.1% daily) | Daily | Very High | Dedicated Fortis staking dashboard, fast daily compounding returns |

| Polkadot (DOT) | ~10–12% annually | Every 24 hours | Medium | Higher yield than ETH/ADA, but slower than Fortis |

| Solana (SOL) | ~8–10% annually | Every few days | Medium | Strong growth, rewards come faster than ETH/ADA |

| Cardano (ADA) | ~5–6% annually | Every 5 days (epoch rewards) | Low | Reliable but designed for long-term profit |

| Ethereum (ETH) | ~4–5% annually | Varies (often weeks) | Low | Most stable option, but very slow profit generation |

Which Crypto Has the Highest APY Rate & Who Pays the Most for Staking Crypto?

When it comes to crypto staking, the coins and platforms with the highest APY rates are typically those designed to attract investors with strong incentive models. Established blockchains like Ethereum (ETH) and Cardano (ADA) pay between 4–6% annually, while mid-tier projects such as Polkadot (DOT) and Solana (SOL) often reach 8–15%. However, the tokens that really stand out for the highest APYs are newer projects offering higher staking rewards to encourage adoption.

Currently, one of the cryptos with the highest APY in crypto staking is Fortis, which offers a fixed 0.1% daily reward (around 36.5% annually with compounding). Unlike traditional platforms where rewards are distributed weekly or monthly, Fortis provides daily payouts through its dedicated staking dashboard. This unique structure allows investors to maximize compounding, making Fortis one of the top-paying options for profitable staking.

When asking who pays the most in crypto staking, the answer often points to projects like Fortis that combine high APYs with daily compounding. While Polkadot and Solana also pay competitive rates, their rewards are not as aggressive or frequent. Fortis stands out because it delivers higher short-term growth and transparent daily rewards, making it more appealing to investors seeking maximum returns.

That said, investors should remember that the cryptos paying the most in crypto staking can also carry higher risks. Extremely high APYs may not be sustainable in the long run if the project lacks adoption or liquidity. The safest strategy is often a balanced approach: allocate some funds to high-reward staking such as Fortis, while keeping a portion in stable options like Ethereum or Cardano for security.

Highest APY Crypto Staking (Comparison)

| Crypto / Token | Typical APY | Who Pays the Most | Notes |

|---|---|---|---|

| Fortis (FTS) | ~36.5% annually (0.1% daily) | Yes – Daily compounding rewards | Dedicated Fortis staking dashboard, high-profit potential |

| Polkadot (DOT) | ~10–12% annually | High but less than Fortis | Strong ecosystem, higher yields than ETH/ADA |

| Solana (SOL) | ~8–10% annually | Medium | Fast transactions, decent returns, some network risks |

| Cardano (ADA) | ~5–6% annually | Low | Reliable, eco-friendly, steady long-term rewards |

| Ethereum (ETH) | ~4–5% annually | Low | Most trusted staking network, but lower APY |

This makes it clear that while Ethereum and Cardano are safe long-term bets, Fortis pays the most for crypto staking, offering the highest APY with daily compounding rewards.

You can read more information about how to start with Fortis Crypto Token from below pages:

How do I start staking Crypto?

Click “Connect Wallet” to link your crypto wallet (like MetaMask).

Enter the amount of FTS tokens you want to stake.

Click “Stake” on this page and approve the transaction.

Your tokens will now be staked, and you’ll start earning rewards.

Where do my staked tokens go?

In the Fortis Crypto Staking System Your tokens are securely locked in the smart contract. They are not sent to any third-party wallet — the contract holds them until you decide to withdraw.

Where will my staking rewards be sent?

Your rewards will be sent directly to your connected wallet address, the same one you used to stake. You can view it under “Reward Will Be Sent To”.

How often do I receive rewards in Fortis Crypto Staking?

Fortis Crypto staking crypto rewards are calculated daily. You can claim them after 24 hours using the “Claim Reward” button.

Can I unstake my tokens anytime?

Yes, you can click the “Withdraw” button at any time to remove your staked tokens and stop earning rewards.

Is there a fee to stake or claim?

There are no platform fees, but you’ll need a small amount of BNB for gas (network) fees when staking, claiming, or withdrawing.

What happens if I close the browser after Fortis Crypto Staking?

Your staking remains active even if you close the browser or disconnect your wallet. Rewards keep accumulating.

Is Fortis Crypto Staking safe?

Yes, the Fortis Crypto Staking contract is deployed on BNB Smart Chain and is public, verified, and transparent. However, always do your own research and never share your private keys.

What is the current reward rate for staking?

The current reward rate is 0.1% per day based on the amount of Fortis (FTS) tokens you have staked. Read more about earning passive income through cryptocurrency investment.

How much can I earn with Fortis Crypto staking?

Here are example earnings at 0.1% daily reward rate and 35% APY which is one of the highest staking rewards:

These are estimates. Your actual rewards may vary slightly depending on exact claim timing.

Is the reward fixed or flexible?

The reward rate (0.1% daily) is fixed for now in Fortis Crypto Staking, but the smart contract is built to support future updates if needed for sustainability. Any changes will be communicated clearly.

Do I have to claim Cryptocurrency rewards daily?

No. Rewards accumulate automatically. You can claim anytime after 24 hours, or let them build up and claim weekly/monthly to save on gas fees.

What if I forget to claim rewards?

Nothing is lost — your unclaimed rewards stay in the contract until you claim them. They continue to accumulate based on your staked amount and time.

Can I stake more Fortis Cryptocurrency tokens later?

Yes. You can stake additional FTS tokens at any time by entering the new amount and clicking “Stake” again in Fortis Crypto Staking dashboard. Your new stake will start earning from the moment it’s added.

Will I still earn rewards if I don’t connect my wallet every day?

Yes. Once staked, your rewards continue accumulating whether your wallet is connected or not. You only need to connect when claiming or staking more.

Is there a minimum or maximum stake amount?

There’s no enforced minimum or maximum, but it’s recommended to stake at least 100 FTS for meaningful rewards and to offset gas fees.

What is the best coin to stake?

The best coin to stake depends on your goals, but popular options include Ethereum (ETH) for long-term stability, Cardano (ADA) for ease of use, and Fortis (FTS) for high fixed daily rewards. Fortis offers in Fortis Crypto Staking ~0.1% daily returns, making it attractive for those seeking fast passive income with a low entry point. Always research the project, rewards, and risks before staking.

Can I lose my tokens by staking?

No — staking is non-custodial. Your tokens are locked in the smart contract of Fortis Crypto Staking, not held by any person or company. Only you can withdraw them using your wallet.

If you have a question you can ask or discuss in Fortis Cryptocurrency Forum.

Is Staking Crypto a Good Idea?

Staking crypto can be a smart way to earn passive income, especially if you believe in the long-term potential of a blockchain project. When you stake your tokens, you’re helping to secure the network—and in return, you earn rewards, usually paid out in the same cryptocurrency.

Benefits of Staking

Passive Income: Earn regular rewards without actively trading.

Lower Risk than Trading: You’re not constantly exposed to market volatility like day trading.

Supports the Network: Staking helps maintain the blockchain’s security and functionality.Compound Gains: You can reinvest your rewards to increase future payouts.

Risks to Consider

Lock-up Periods: Some staking programs require you to lock your tokens for a certain time.Market Volatility: If the token’s price drops, the rewards may not offset your lossesSmart Contract Risk: If you’re using a third-party platform or DeFi protocol, there’s a risk of bugs or exploits.Inflation: In some cases, the supply of the token may increase over time, potentially reducing its value.

Who Is It Good For?

Long-term holders who aren’t planning to sell soon.

Those who want to support a blockchain project they believe in.

People looking for low-effort ways to earn crypto rewards.

Bottom Line:

Staking is generally a good idea for long-term believers in a project. It’s not risk-free, but if done with research and a clear strategy, it can generate steady returns while helping to grow the ecosystem you’re invested in.

Is crypto staking considered income?

Yes, in most countries, crypto staking rewards are considered taxable income and also from Fortis Crypto Staking. When you receive staking rewards (like additional tokens), they are typically taxed based on their fair market value at the time you receive them. Be sure to check your local tax laws or consult a tax advisor for accurate guidance. Also Read about Tax obligations. Cryptocurrency and Tax – Australian Taxation Office (ATO)

Is staking illegal in Australia?

No, staking is not illegal in Australia. It is legal to stake cryptocurrency, and many Australians participate in staking to earn passive income through Crypto staking system like Fortis Crypto Staking . However, staking rewards are considered taxable income by the Australian Taxation Office (ATO), and you must report them when lodging your tax return.

What is crypto staking?

Staking is the process of locking up your cryptocurrency in a smart contract to earn rewards, usually in the same token.

What’s the minimum amount to stake?

There’s no enforced minimum. You can stake any amount of FTS tokens.

Can I withdraw my stake anytime?

Yes, but the contract has a minimum 24-hour lock period before you can withdraw or claim rewards.

Where do rewards go after claiming?

Rewards are paid directly to your connected wallet (e.g. MetaMask).

What is the Fortis staking reward rate?

Fortis staking pays 0.1% daily of your staked amount.

Are Fortis Crypto Staking rewards automatic?

No. You must manually claim rewards or withdraw stake to receive them.

Do I pay gas fees when staking Crypto?

Yes. Transactions like staking, claiming rewards, and withdrawing require small BNB gas fees on BSC.

Is staking crypto legal in Australia?

Yes. Staking is legal in Australia and widely practiced.

Is staking considered income?

Yes. According to the ATO, staking rewards are considered ordinary income and must be reported for tax purposes.

Will I be taxed when I stake or claim?

You’re taxed on the value of the rewards at the time you receive them. Selling the rewards later may trigger capital gains tax (CGT).

Which wallet should I use for Fortis staking?

MetaMask or Trust Wallet on Binance Smart Chain (BEP-20) is recommended.

What is the smart contract address for staking?

0x2087BBE88011ee7557813f647d61f24c599EB11A (Verified on BscScan)

Where can I see the contract?

Check the verified contract on BscScan.

Is staking your crypto worth it?

Yes, crypto staking can be worth it if you want to earn passive income while holding your coins long term. By locking tokens on a Proof-of-Stake blockchain, you can earn rewards ranging from 4% to over 30% annually, depending on the project. For example, Fortis offers daily compounding at 0.1% per day, making it highly profitable compared to traditional savings.

Which crypto is best for staking?

The best options for crypto staking depend on your goals. Ethereum (ETH) and Cardano (ADA) are ideal for stability and low risk, while Polkadot (DOT) and Solana (SOL) offer higher APYs. For those seeking maximum profitability, Fortis staking stands out with daily rewards and one of the highest compounding APYs available.

Is staking better than holding?

For many investors, crypto staking is better than holding because it provides regular staking rewards on top of potential price growth. Holding alone relies only on market appreciation, while staking compounds your portfolio over time. However, if you need liquidity during volatile markets, holding may be more flexible.

Is staking crypto safe for beginners?

Yes, crypto staking is relatively safe for beginners if done on reputable platforms. Using exchanges like Binance, CoinSpot, or dashboards such as Fortis reduces the technical barriers. Still, beginners should understand risks like token volatility, lock-up periods, and potential slashing penalties on some blockchains.

Does staking make you money?

Yes, crypto staking makes money by generating staking rewards in the form of additional tokens. The profit depends on the APY offered by the blockchain or platform. For example, Ethereum might yield 4–5% annually, while Fortis can generate around 36.5% with daily compounding.

What is the most profitable staking crypto?

Currently, one of the most profitable crypto staking options is Fortis, offering 0.1% daily (36.5% annually) with compounding rewards. Polkadot and Solana are also profitable with 8–15% APYs, while Ethereum and Cardano provide safer but smaller returns.

Which crypto platform is best for staking?

The best crypto staking platforms vary depending on your needs. For Australians, Swyftx and CoinSpot are reliable, while global platforms like Binance and Kraken offer wider coin support. For high-profit opportunities, the Fortis staking dashboard is one of the best choices due to daily compounding and transparent rewards tracking.

Does crypto staking pay daily?

Some platforms for crypto staking do pay daily, while others distribute rewards weekly or monthly. Fortis is an example of a daily-paying staking platform, offering 0.1% returns every day. Ethereum and Cardano typically distribute rewards less frequently, often every 5–15 days.

Who pays the most for staking crypto?

In terms of APY, Fortis staking pays the most for crypto staking, with around 36.5% annually through daily rewards. By comparison, Polkadot pays ~12%, Solana ~9%, and Ethereum ~4–5%. Fortis currently leads as one of the highest-paying staking options available.

Where is the safest place to stake crypto?

The safest place for crypto staking is on trusted platforms and exchanges with strong security and regulatory compliance. Popular choices include Binance, Kraken, and Coinbase globally, and platforms like Swyftx and CoinSpot in Australia. These services manage validator risks, provide insurance in some cases, and simplify the staking process for beginners. For higher rewards, investors also use dedicated dashboards such as Fortis staking, but the safest approach is to combine reputable exchanges with secure wallets to protect your funds while earning rewards.