Fortis Token Locks- Best For Safe Investment in Cryptocurrency

Introduction to Fortis Token Locks & Security.

Cryptocurrency projects must prioritize security and transparency to gain investor trust and ensure long-term sustainability. One of the most effective ways to do this is through token locking, a process where a portion of a project’s total supply is placed in a secure smart contract and made inaccessible for a fixed period.

Fortis Cryptocurrency has implemented token locking as part of its commitment to security. By locking 70 million FTS tokens on Mudra Token Locker, Fortis eliminates the risk of sudden price crashes due to team sell-offs. This move also reassures investors that the project is not a pump-and-dump scheme and is focused on long-term growth.

Why is Locking Tokens Important for Investor Trust? : Fortis Token Locks

Prevents Token Dumps – Many investors fear that developers will dump their holdings, causing prices to plummet. Locking tokens ensures that a significant portion of the supply remains untouched, stabilizing the market.

Boosts Transparency – Investors can verify that the tokens are locked by checking the blockchain, ensuring full transparency. This fosters confidence in the project’s legitimacy.

Enhances Price Stability – With a large supply locked, the circulating supply remains controlled, preventing extreme volatility and price manipulation.

Protecting Investors from Rug Pulls & Market Manipulation : Fortis Token Locks

A rug pull occurs when project creators sell a large number of tokens at once, crashing the price and leaving investors at a loss. Since Fortis has locked 70% of its total supply, it prevents any risk of sudden liquidity drain or malicious dumping.

Fortis isn’t just another crypto project—it’s built to last.

Read more about Fortis Tokenomics: Learn More

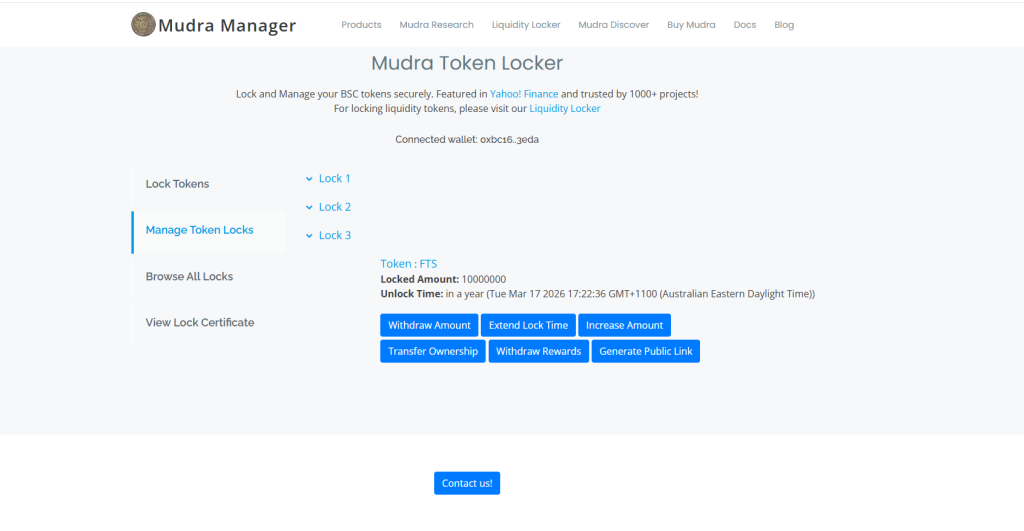

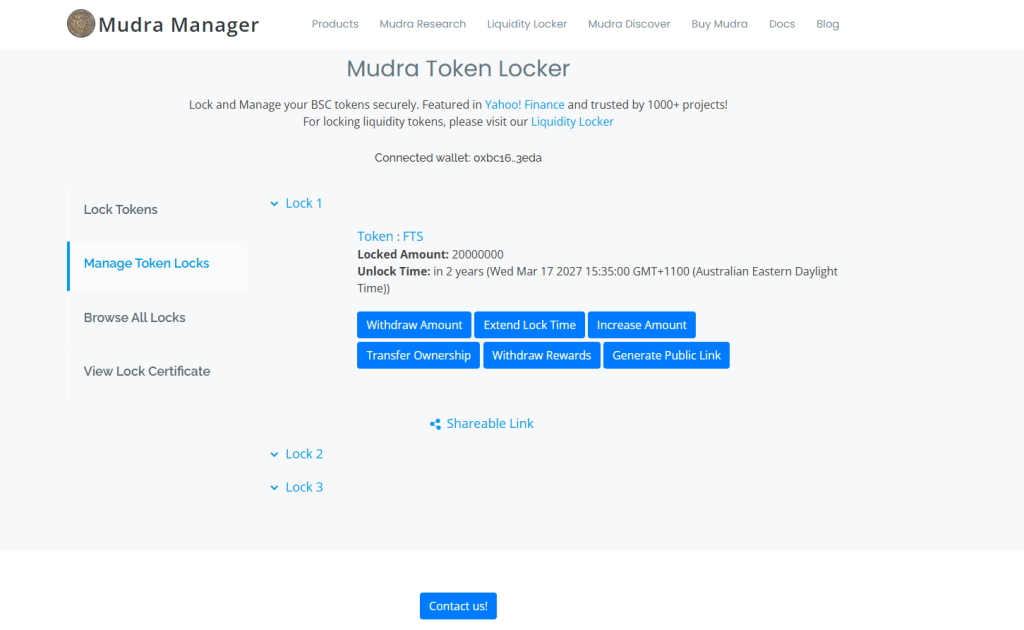

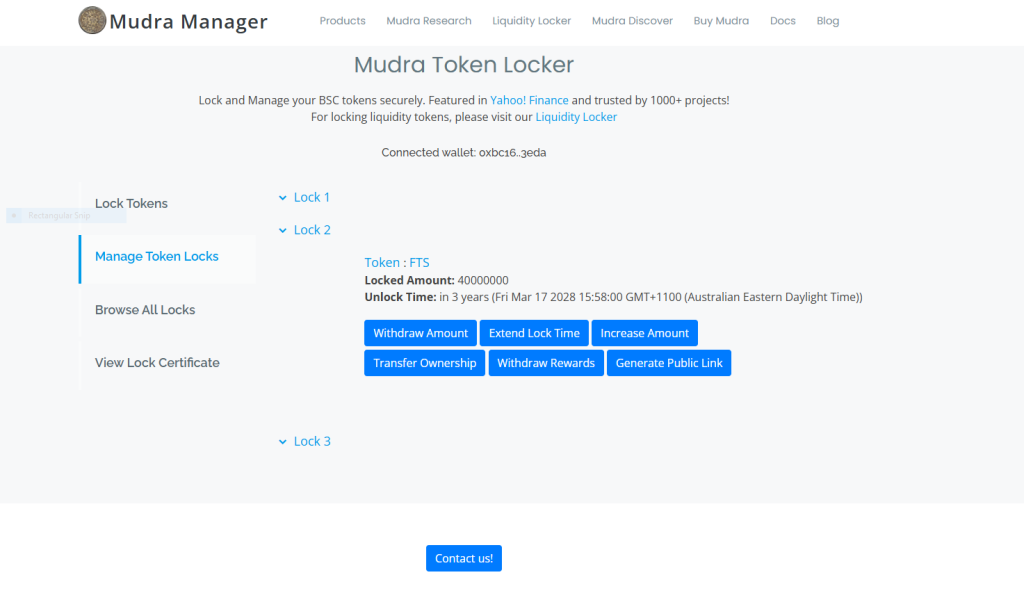

Fortis Tokens Locks on Mudra – Key Details

To ensure stability, transparency, and investor confidence, Fortis Cryptocurrency has locked 70 million FTS tokens using the Mudra Token Locker. This lock prevents unauthorized sales or dumps that could negatively impact the token’s price and market trust.

Here are the key details of the Fortis token locks:

- Total Tokens Locked: 70,000,000 FTS

- Lock Date: March 14, 2025

- Unlock Date: March 17, 2028

- Lock Platform: Mudra Token Locker

- Lock Duration: 3+ years

- Unlock Schedule: Tokens will remain locked for over 3 years, ensuring long-term market stability

Why Locking 70M FTS is Crucial

- Prevents team sell-offs – Ensures that a majority of tokens are not suddenly dumped into the market, protecting investors from price crashes.

- Boosts credibility – Investors prefer projects where founders cannot suddenly liquidate their holdings, ensuring commitment to growth.

- Long-term sustainability – The locked tokens demonstrate that Fortis is a serious project, focused on long-term success rather than short-term gains.

How to Verify the Fortis Token Locks

Investors can verify the locked tokens in real time using the following blockchain and security links:

- Fortis Token Locks Status on Mudra

- BSC Scan Fortis Token Locks Transaction: View on BscScan

This level of transparency and verification allows all investors to confirm that Fortis is a secure and trusted project.

Fortis is built for a secure, decentralized future.

Learn more about Fortis on our About Page: Click Here

Why Fortis Locked a Majority of Tokens?

Fortis Cryptocurrency has locked 70 million FTS tokens as a strategic move to ensure the long-term stability of the project. This decision was made to build investor confidence, prevent market manipulation, and demonstrate our commitment to the community.

Key Reasons for Locking the Majority of Tokens

Fortis Token Locks Prevents Price Manipulation

- Locking a large portion of the supply prevents sudden large sell-offs that could negatively impact token value.

- This protects investors from extreme price fluctuations and ensures a stable market for Fortis.

Fortis Token Locks Increase Investor Confidence

- A locked supply reassures investors that the team cannot dump tokens on the market for personal gains.

- This transparency helps build trust and credibility, making Fortis a safer investment choice.

Ensure Fair Market Conditions for Long-Term Success

- By keeping the majority of tokens locked, only a limited supply remains in circulation, reducing inflation risks.

- This approach supports gradual and organic growth rather than rapid and unsustainable spikes.

How Fortis Token Locks Benefits Fortis Investors

- Reduces risks of a rug pull – Since the team cannot access the locked tokens, investors can be assured that the project is secure and trustworthy.

- Creates a strong long-term foundation – With a large portion of supply locked, the price remains more stable as demand increases over time.

- Encourages more adoption & listings – Secure tokenomics make Fortis more attractive for exchanges, partnerships, and large investors.

Fortis is committed to ensuring a fair and decentralized financial ecosystem. Our token lock strategy is just one of the many steps we’ve taken to protect our investors and secure long-term success.

Future Plans for Locked Tokens

Fortis Token Locks: Locking 70 million FTS tokens was a strategic move to build trust and ensure the stability of Fortis. However, what happens when the lock period ends? Our approach is designed to maintain long-term security while ensuring a smooth transition when these tokens are gradually introduced into circulation.

How Tokens Will Be Released After the Lock Period : Fortis Token Locks

Fortis follows a gradual release strategy to prevent sudden supply shocks. Here’s how we plan to handle the locked tokens after March 17, 2028:

Gradual Unlocking in Phases

- Tokens will not be released all at once but rather in staggered portions over time.

- This prevents any sudden sell-offs that could impact market stability.

- Fortis will announce each unlocking event in advance, keeping investors informed.

Reinvesting a Portion into Liquidity Pools

- To increase market depth and price stability, a portion of the released tokens will be added back to liquidity pools on PancakeSwap and other DEXs.

- This ensures smoother price movement and prevents excessive volatility.

Development & Ecosystem Growth

- A portion of the unlocked tokens will be allocated to future project development.

- This includes funding new utilities, partnerships, and upcoming features in the Fortis ecosystem.

Community Incentives & Staking

- Some of the released tokens may be used for staking rewards, governance voting, and incentivizing long-term holders.

- Fortis will prioritize rewarding active and loyal community members.

How Additional Liquidity Will Be Added Periodically : Fortis Token Locks

Adding liquidity consistently is key to sustaining the Fortis market and ensuring seamless trading. Here’s how Fortis plans to enhance liquidity over time:

- Scheduled Liquidity Injections – Additional liquidity will be added at key milestones to support a growing trading volume.

- Community-Driven Governance – The Fortis community will have a say in how tokens are gradually unlocked and used.

- Exchange Listings & Partnerships – As more tokens unlock, Fortis aims to list on top-tier centralized exchanges (CEXs) and expand liquidity pools.

Fortis remains committed to a structured, sustainable token release strategy. This ensures that token holders continue to benefit from price stability, security, and long-term growth opportunities.

Explore Fortis Token Security & Locks: Click Here

Why did Fortis lock 70 million tokens?

Locking 70 million FTS tokens ensures security, prevents price manipulation, and builds investor confidence by guaranteeing that a majority of tokens cannot be dumped suddenly.

Where are the Fortis tokens locked?

The tokens are locked on Mudra Token Locker, a trusted and secure platform for locking liquidity and tokens.

How long will the Fortis tokens remain locked?

The Fortis tokens have been locked until March 17, 2028, ensuring long-term security for investors.

Can the locked tokens be unlocked before the set date?

No, once locked, the tokens cannot be accessed or moved until the lock period ends, providing full security to investors.

How can I verify the locked tokens?

You can verify the locked tokens by checking the Mudra Token Locker live lock status and the BscScan transaction record for proof of security.

Will more tokens be locked in the future?

The Fortis team may consider additional token locks based on project developments and investor needs to further enhance trust.

What happens when the lock period ends?

After the lock period ends in 2028, the tokens will be gradually reintroduced to support liquidity and future project developments.

Does locking tokens help prevent rug pulls?

Yes, locking tokens prevents sudden dumping by the project team and ensures fair market conditions for long-term growth.

How does token locking impact Fortis token holders?

Token locking stabilizes the price and ensures a secure investment, making Fortis a more trustworthy and long-term project.

Where can I track updates about Fortis token security?

You can follow FortisCrypto.com, Telegram, Twitter, and Reddit for regular updates on token locks and security measures.